Lazada Pay Later To Cash: How to Convert Lazada PayLater Credit into Cash

With the rise of buy-now-pay-later services in Southeast Asia, Lazada Pay Later has become a popular online payment method for millions of shoppers. But what if you want to convert your Lazada Pay Later credit into cash? This article explores the possibilities, limitations, and practical ways to use Lazada Pay Later to cash out funds effectively.

What is Lazada Pay Later?

Lazada Pay Later is a flexible payment method offered by Lazada, one of Southeast Asia’s leading e-commerce platforms. It allows customers to buy products immediately and pay for them in installments or within a certain period, interest-free or with low fees. This service is designed to promote online shopping without the need for instant cash payment.

Key Features of Lazada Pay Later

- Instant online credit upon approval

- Flexible payment terms (usually 30 days or installment plans)

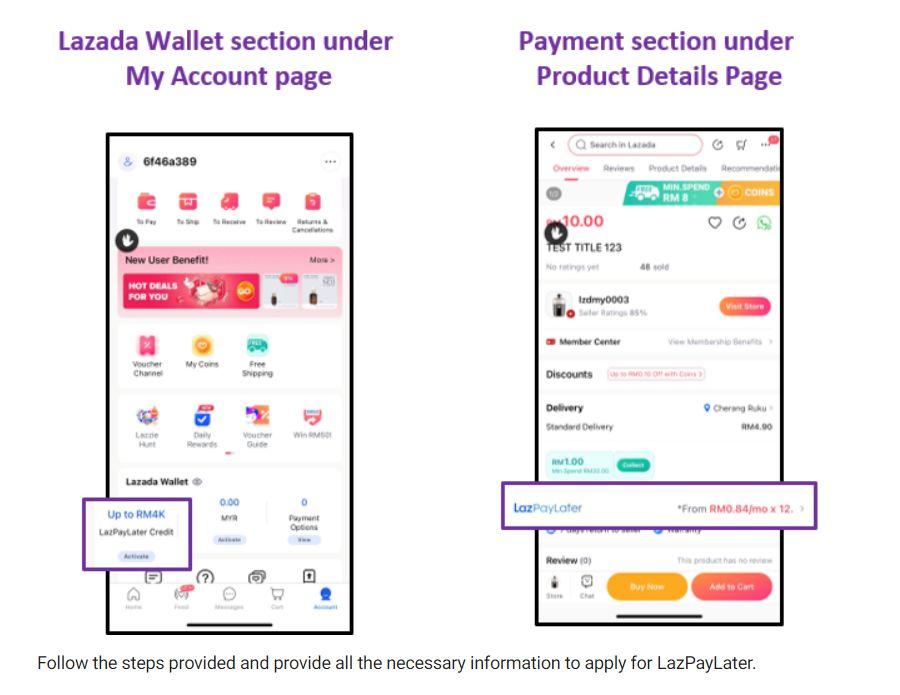

- Easy application via Lazada app

- Secured by user identity verification and credit scoring

Can You Convert Lazada Pay Later to Cash?

One of the most common questions about Lazada Pay Later is whether you can withdraw the credit as cash directly. The straightforward answer is: no, Lazada does not allow direct cash withdrawals of PayLater credit. The credit is meant strictly for purchasing goods and services on Lazada’s platform. However, there are indirect ways users can leverage Lazada Pay Later to get cash, though they come with risks and considerations.

Why Isn’t Direct Cash Withdrawal Allowed?

- Risk Management: Lazada limits misuse of credit to reduce fraud and financial risks.

- Business Model: The credit is designed to boost sales, not act as a cash advance.

- Compliance: Financial regulations often restrict cash advances on consumer credit platforms.

Indirect Ways to Use Lazada Pay Later for Cash

Even though you can’t withdraw Lazada Pay Later credits directly, here are some common workarounds people use to “convert” their credit into cash:

1. Purchase Items to Resell

One popular method is buying high-demand products using Lazada Pay Later, and then selling them offline or via other platforms for cash. This method requires market knowledge and usually works best with electronics, gadgets, or trending consumer goods.

2. Buy Vouchers or Gift Cards

Some users purchase digital gift cards or vouchers using Lazada Pay Later and then sell or trade these cards for cash. This method depends on the availability of vouchers on Lazada and the demand among buyers.

3. Use Lazada Pay Later for Essentials and Save Cash

A clever indirect approach is to buy daily essentials or items you would purchase anyway via Lazada Pay Later, then keep the cash you saved aside. While not a direct withdrawal, it frees up your liquid cash effectively.

Benefits of Using Lazada Pay Later

Whether you use it for its intended purpose or explore indirect ways, Lazada Pay Later offers significant benefits:

- Instant Purchasing Power: Shop even when short on cash.

- Flexible Repayment: Pay over time with manageable installments.

- Easy and Secure: Seamless integration within Lazada.

- Boosts Budgeting: Allocate payments across months rather than a lump sum.

Practical Tips for Using Lazada Pay Later Safely

Before attempting any workaround or simply using Lazada Pay Later, consider these best practices:

- Understand Repayment Terms: Know your billing cycle and due dates to avoid penalties.

- Budget Wisely: Only spend what you can realistically pay back within the period.

- Avoid Fraudulent Transactions: Stay away from risky resale schemes or unofficial resellers.

- Monitor Your Credit Limit: Keep track of available credit and repayment plans to avoid overuse.

Example Comparison Table: Lazada Pay Later vs. Other Pay Later Services

| Feature | Lazada Pay Later | Competitor Pay Later |

|---|---|---|

| Credit Limit | Up to PHP 15,000 (varies by user) | Up to PHP 50,000 |

| Direct Cash Withdrawal | Not allowed | Some allow (with fees) |

| Repayment Period | Up to 30 days or installment | 15-60 days |

| Interest & Fees | Usually zero or low interest | Varies, sometimes high |

| Use Case | Online Lazada purchases only | Wider merchant acceptance |

First-Hand Experience: Using Lazada Pay Later

Maria, a student and part-time freelancer, shares her experience: “I started using Lazada Pay Later to smooth out my budget during exam season. Since I couldn’t afford to buy everything upfront, the credit helped me get my textbooks early. Though I can’t cash it out, buying essentials freed my pocket money for other bills. It’s a convenient option as long as you are disciplined.”

Conclusion

Lazada Pay Later is a revolutionary tool for shoppers seeking flexibility in their purchases without immediate financial strain. While converting Lazada Pay Later credit directly to cash isn’t available, indirect workarounds like reselling purchases or buying and selling vouchers can serve as creative solutions-if approached carefully. The key is to use this credit facility responsibly, fully understanding repayment terms and limits to avoid falling into debt traps.

Whether you want to use Lazada Pay Later to cover big shopping needs or you’re exploring ways to get more financial leverage, remember that it’s a tool designed to enhance your spending power safely. Stay informed, plan your payments, and enjoy more freedom shopping online!

Keywords: Lazada Pay Later to cash, Lazada Pay Later cash out, Lazada Pay Later withdrawal, how to convert Lazada Pay Later into cash, Lazada Pay Later tips, buy now pay later Lazada, Lazada credit payment, Lazada PayLater benefits