How To Submit Itr Online

How To Submit ITR Online: Step-by-Step Guide to Filing Your Income Tax Return

Filing your Income Tax Return (ITR) online is a crucial financial responsibility that many taxpayers encounter annually. With the Indian government promoting digital processes, online submission of ITR has become more accessible, efficient, and hassle-free. This detailed guide walks you through how to submit ITR online in a few easy steps, ensuring accuracy and compliance with tax laws.

Understanding the Basics: What is ITR?

An Income Tax Return (ITR) is a form where taxpayers report their income, deductions, and taxes paid to the Income Tax Department. Filing the ITR is mandatory for various categories of taxpayers based on their income threshold, investments, or if they want to claim refunds. With the online portal of the Income Tax Department, the process of submission has been simplified, making online ITR filing a preferred method.

Why File ITR Online? Benefits You Should Know

- Convenience: File returns anytime, anywhere without visiting tax offices.

- Speed and Accuracy: Pre-filled details minimize manual errors.

- Instant Acknowledgement: Get electronic confirmation immediately after filing.

- Secure Process: Enhanced data security through encrypted government portals.

- Easy Refund Process: Speedy processing and direct transfer of refunds.

Prerequisites Before Filing ITR Online

Before you begin the online ITR submission, ensure you have the following ready to smoothen the process:

- PAN Card: Permanent Account Number is mandatory.

- Aadhaar Number: Linking Aadhaar with PAN is essential.

- Bank Account Details: For refund processing.

- Form 16: Issued by your employer showing salary details and TDS deducted.

- Other Income Sources: Details of interest, dividends, or capital gains.

- Tax Payment Receipts: Challans for advance tax or self-assessment tax paid.

- Digital Signature (optional): For some categories, DSC is necessary.

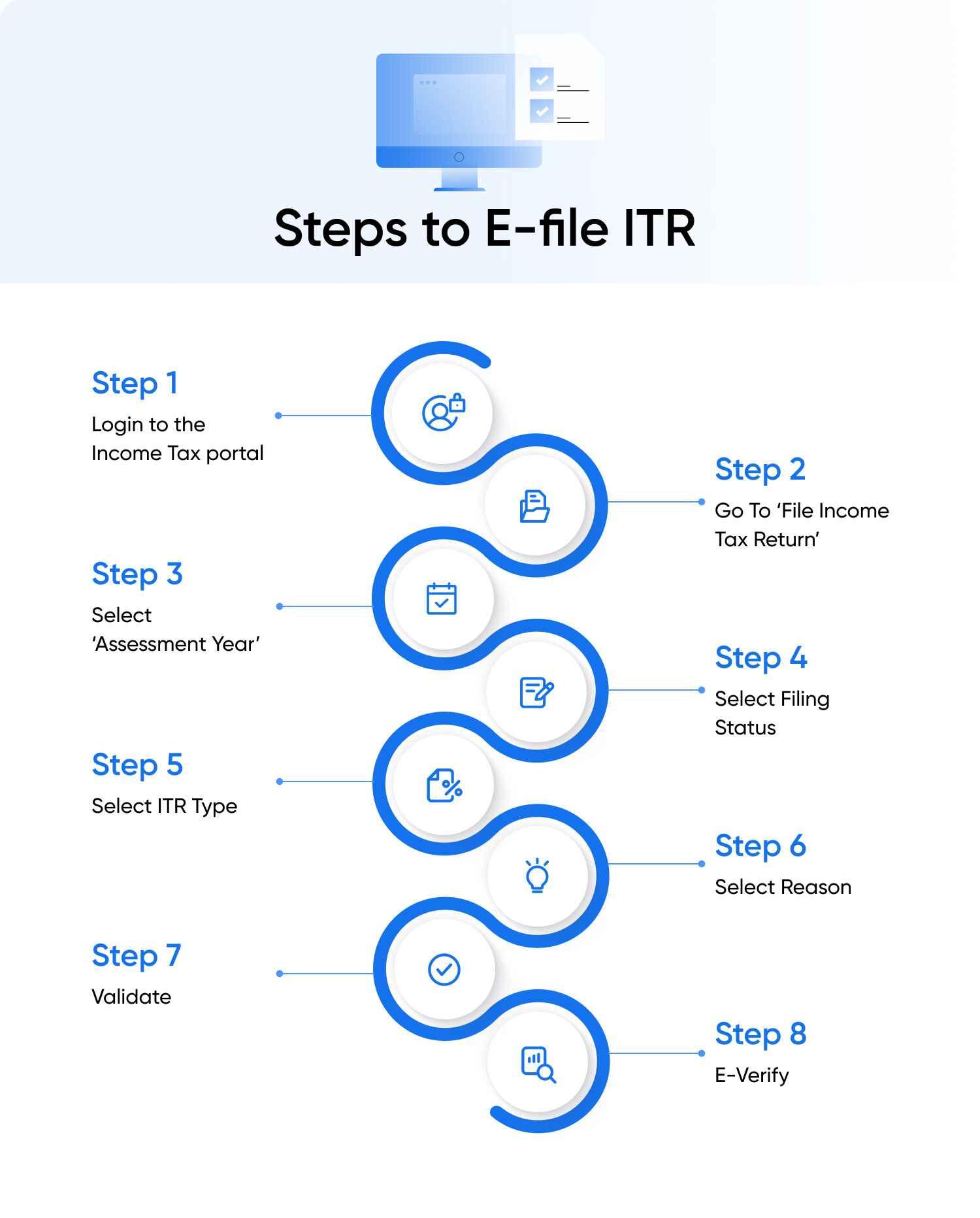

Step-by-Step Process: How To Submit ITR Online

Step 1: Register on the Income Tax E-Filing Portal

Visit the official Income Tax e-filing website at incometax.gov.in. If you are a first-time user, click on ‘Register Yourself’ and create an account using your PAN, name, date of birth, and contact details.

Step 2: Log In Using Your Credentials

Once registered, log in using your User ID (PAN), password, and CAPTCHA code.

Step 3: Select the Appropriate ITR Form

On the dashboard, select ‘File Income Tax Return’. Choose the correct ITR form based on your income type:

| Income Type | ITR Form Number |

|---|---|

| Salaried individuals | ITR-1 (Sahaj) |

| Individuals/Businesses with rental or capital gains income | ITR-2 |

| Business owners/Professionals | ITR-3 |

| Companies and LLPs | ITR-4 and above |

Step 4: Fill in Your Income Details

Enter the income details carefully-salary, house property, capital gains, other sources, and exemptions. The portal often pre-fills information based on Form 26AS and Form 16, helping prevent errors.

Step 5: Claim Deductions and Set Off Losses

Make sure you claim applicable deductions under sections like 80C, 80D, etc., to lower your taxable income.

Step 6: Calculate Tax and Pay Any Outstanding Amount

The portal automatically calculates your tax liability. If you owe additional tax, pay it online using the available payment modes before submitting the return.

Step 7: Verify and Submit Your Return

After reviewing all the details, submit your ITR. You can verify your ITR:

- Online using Aadhaar OTP or Net Banking

- By sending a signed ITR-V to CPC Bangalore within 120 days

- Using Digital Signature Certificate (DSC)

Helpful Tips for a Smooth Online ITR Submission

- Always use a secure and updated browser for the best portal experience.

- Keep all your documents handy before you start filing.

- Double-check pre-filled data for accuracy and update if necessary.

- File before the deadline to avoid penalties and late fees.

- Maintain a soft copy and acknowledgment receipt for your records.

Common Issues and Troubleshooting

If you encounter problems while submitting your ITR online, here are some common solutions:

- Portal Login Issues: Reset password using the ‘Forgot Password’ link or clear browser cache.

- Form Selection Errors: Confirm your income source and refer to the official list to pick the correct form.

- Verification Delays: Use Aadhaar OTP for instant online verification.

- Refund Delays: Check bank details accuracy and ensure your PAN is linked with Aadhaar and bank account.

Case Study: Successful ITR Filing Experience

Ravi, a salaried professional from Bangalore, used the online filing process to submit his ITR-1 this year. He highlighted how the pre-filling feature saved time and minimized mistakes. Ravi opted for Aadhaar OTP verification, which helped him complete the process in under 30 minutes. Thanks to filing early, he received his tax refund within two weeks, illustrating the efficiency of online filing.

FAQs About Submitting ITR Online

| Question | Answer |

|---|---|

| Can I file ITR online without registration? | No, registration is mandatory to access the e-filing portal services. |

| Is online ITR filing free? | Yes, the official portal allows free filing of ITR for all individuals. |

| How do I know which ITR form to use? | ITR form selection depends on your income type and category, as explained above. |

| What documents are needed to file ITR online? | PAN, Aadhaar, Form 16, bank details, and income proofs are essential documents. |

| Can I revise my ITR after submission? | Yes, you can file a revised return before the end of the relevant assessment year. |

Conclusion

Submitting your ITR online is an efficient and secure way to fulfill your tax compliance obligations. By following this comprehensive guide on how to submit ITR online, you can confidently handle your tax filing with minimal hassle. Leveraging the government’s e-filing portal benefits taxpayers with faster processing times, fewer errors, and easier refund transfers. Remember to gather all your documents in advance, select the right ITR form, and verify your return promptly for a smooth experience.

Start your online ITR filing journey today, and make tax compliance simpler and stress-free!