How To Get A Copy Of My Itr Philippines Online

How To Get A Copy Of My ITR Philippines Online

Are you wondering how to get a copy of your Income Tax Return (ITR) in the Philippines online? Whether you misplaced your ITR or need it for verification, loan applications, or personal records, accessing your ITR copy digitally saves time and effort. This comprehensive, SEO-optimized guide will walk you through the simple steps to obtain your ITR online from the Bureau of Internal Revenue (BIR) and other official channels.

What is an ITR and Why Do You Need a Copy?

An Income Tax Return (ITR) is a document that individuals and businesses file with the BIR to declare their income, deductions, and tax liabilities for a specific fiscal year. Having a copy of your ITR is essential in many situations:

- Proof of income for loan or credit applications

- Tax compliance verification during audits

- Filing of other government documents

- Personal financial recordkeeping

- Employment requirements

Understanding Online Availability of ITR in the Philippines

Thanks to the BIR’s modernization initiatives, many taxpayers can now access their previous tax filings online through the BIR Electronic Filing and Payment System (eFPS) or eBIRForms system. However, availability may depend on how your ITR was filed and if you have a registered account with the BIR’s online portals.

Step-By-Step Guide: How To Get A Copy of Your ITR Philippines Online

1. Register for a BIR Online Account

If you haven’t done so yet, the first step is to register to the official Bureau of Internal Revenue (BIR) website. Here are the required steps:

- Go to BIR eFPS portal or eBIRForms System.

- Click on the “Register” button and fill in your Taxpayer Identification Number (TIN), full name, and other required details.

- Submit your registration and wait for email confirmation.

2. Log in to Your BIR eFPS or eBIRForms Account

Once registered, access your account by logging in with your credentials. This platform allows you to electronically file, view, and download your tax returns.

3. Navigate to Your Filed ITR Records

Within the portal, locate the “Filed Returns” or “My Tax Records” section to view a list of your submitted Income Tax Returns.

4. Download or Print Your ITR

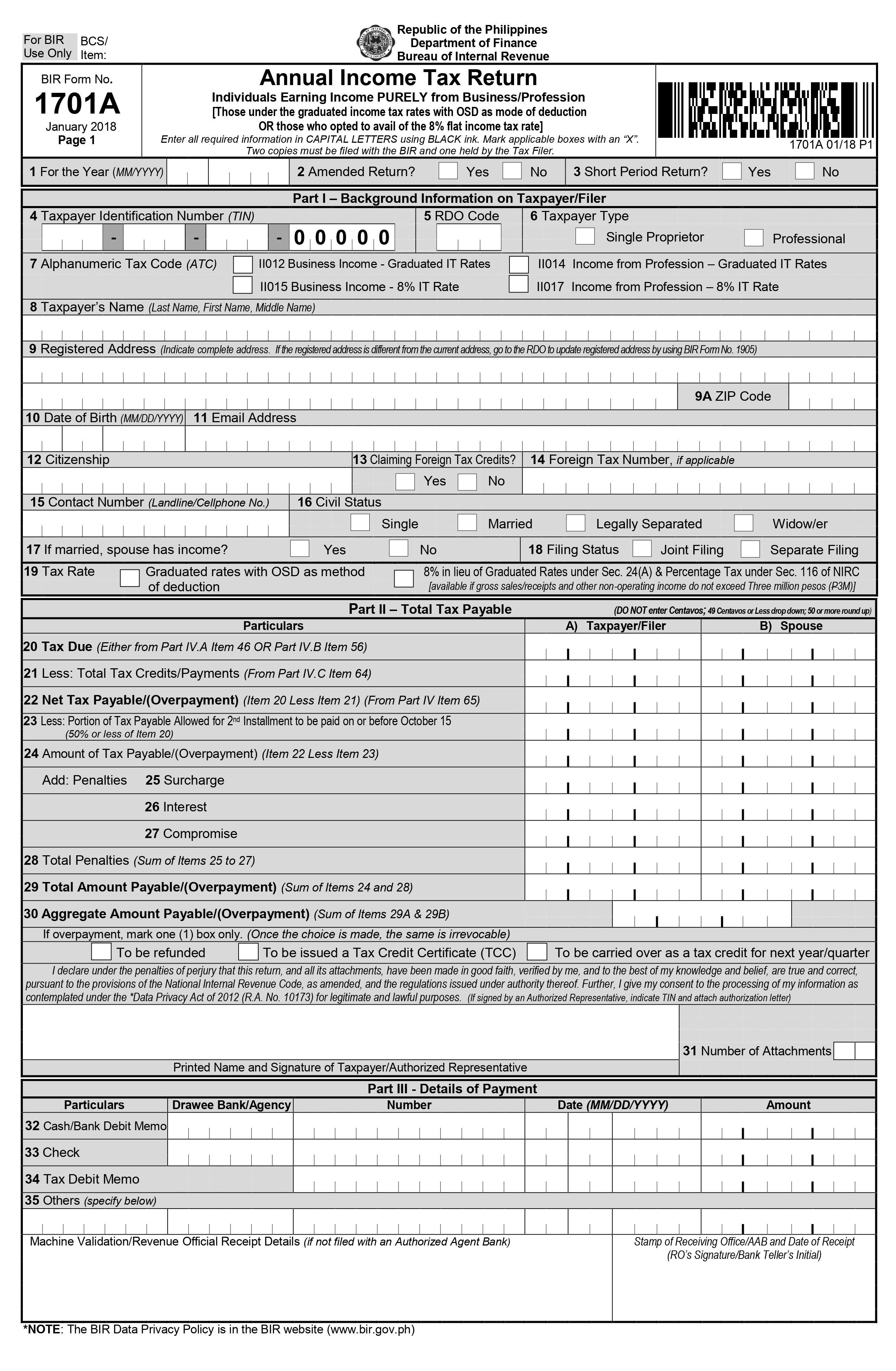

Select the desired year and type of ITR (e.g., 1700, 1701) and click the download or print option to save a digital copy or get a physical one.

Alternative Method: Requesting ITR Copies via BIR Offices Online

If you’re not registered online or cannot access your electronic account, you may request a certified true copy of your ITR by submitting a formal request through the BIR’s official channels.

- Visit the nearest BIR Revenue District Office (RDO) website or customer service online portal.

- Fill out a Letter of Request addressed to the Revenue District Officer (RDO).

- Provide a valid ID and proof of taxpayer status.

- Submit payment for copy fees if required.

- Wait for their confirmation and instructions on how to get your ITR copy.

Benefits of Getting Your ITR Online

- Convenience: No need to visit BIR offices physically.

- Faster Processing: Instant download or email delivery.

- Environment-Friendly: Less paper use with digital copies.

- 24/7 Access: Available anytime through secure portals.

Important Tips When Downloading Your ITR Online

- Ensure your internet connection is stable.

- Use official government websites only to avoid scams.

- Keep your login credentials private and secure.

- Confirm your TIN and personal information before submission.

- Check if your ITR was filed electronically to ensure online availability.

Common Questions About Getting Your ITR Online

| Question | Answer |

|---|---|

| Can I get my ITR without logging in online? | Yes, through a formal request at the BIR RDO, but this takes longer. |

| Is there a fee to download my ITR online? | No, downloads are free on eFPS or eBIRForms platforms. |

| How long does it take to get my ITR copy? | Instant if online; 3-7 days if requested via BIR office. |

| What if I forgot my BIR account password? | Use the “Forgot Password” link on the login page to reset it. |

Firsthand Experience: Getting My ITR Copy Online in the Philippines

As a registered user of the BIR eFPS system, I found the process straightforward. After logging in, I navigated to the filed returns section, selected the year, and downloaded a clean PDF copy of my ITR 1701. The entire process took less than 10 minutes-much faster than waiting in line at the local BIR office. Having this convenient accessibility has saved me time during bank loan applications and business requirements.

Conclusion

Obtaining a copy of your Income Tax Return (ITR) in the Philippines online is both simple and efficient, especially through the BIR’s eFPS and eBIRForms platforms. By registering an account, you gain instant access to your tax documents wherever and whenever you need them. For those unable to use online services, the formal request via your local BIR office remains an option. Follow the steps outlined above to get your ITR copy hassle-free-making your tax compliance and financial transactions smoother and faster.

For more tips on navigating the Philippine tax system, stay tuned to our blog or visit the official BIR website.