Gcash Charge Cash In: Easy & Fast Ways to Reload Your Wallet

In today’s digital age, managing your money has never been easier – especially with e-wallets like Gcash. One key aspect users need to master is how to charge cash in their Gcash wallet quickly and securely. Whether you are new to Gcash or looking for optimized ways to reload your account, this guide will take you step-by-step on what Gcash charge cash in means, the popular methods, fees involved, and practical tips for a smooth experience.

What is Gcash Charge Cash In?

Gcash charge cash in refers to the process of adding money or reloading funds into your Gcash mobile wallet. This step is essential before you can use Gcash to pay bills, send money, shop online, or make QR payments.

Once your Gcash wallet has sufficient balance, you unlock a world of seamless and cashless financial transactions straight from your smartphone.

Why is Cashing In to Gcash Important?

- Convenience: Reload anytime, anywhere, eliminating the need for physical cash.

- Speed: Instant or near-instant credit to your wallet for immediate use.

- Access to Services: Bill payments, online shopping, sending money, and more.

- Security: Avoid carrying cash and reduce theft or loss risks.

Popular Methods to Charge Cash In Gcash

Gcash offers multiple convenient ways to load money into your wallet. Here are the most popular and reliable methods:

1. Over-the-Counter (OTC) Cash In

Visit partner outlets like 7-Eleven, Cebuana Lhuillier, Palawan Pawnshop, or SM Business Centers to cash in physically at the counter.

- Bring your mobile number or Gcash QR code.

- Deposit the amount you wish to add.

- Pay the amount plus any applicable service fee.

Pros: No bank account needed; easy for cash users.

2. Bank Transfer or Online Banking

Link your bank account to Gcash or use online banking apps that allow fund transfers to Gcash using your registered mobile number.

- Use banks such as BDO, BPI, Metrobank, and others.

- Transfer funds via PESONet or InstaPay to your Gcash wallet.

Pros: Convenient for bank users, sometimes fee-free.

3. Mobile Wallet to Wallet Transfer

If you have a friend or family member with Gcash balance, they can transfer funds instantly to your wallet.

- Simply share your registered Gcash mobile number or QR code.

- The sender initiates a send money transaction.

Pros: Instant, no extra fees when within Gcash network.

4. Gcash Mastercard or Linked Card Reload

You can cash in by linking your debit or credit card to your Gcash wallet and doing an online cash-in.

- Tap the “Cash In” from your app dashboard.

- Select “Credit/Debit Card” as payment method.

Pros: Fast and more flexible reload options.

5. Load Wallet via Remittance Centers

Some remittance centers partner with Gcash for cash in/out services – ideal for OFWs sending money home.

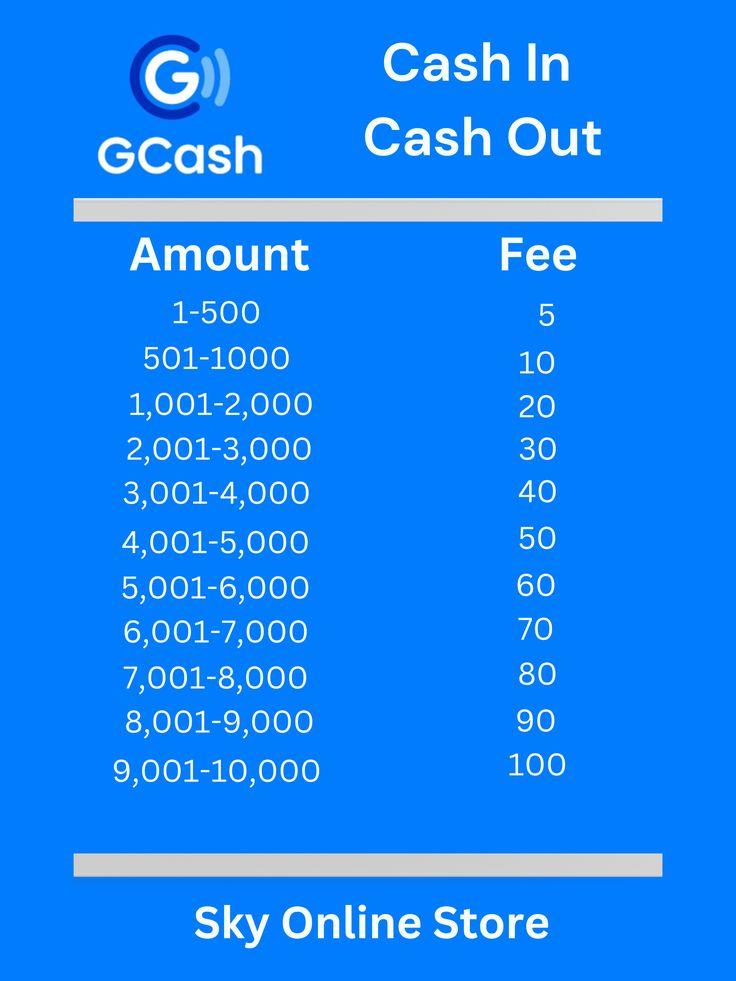

Gcash Charge Cash In Fees and Limits

Most Gcash cash in methods are free up to certain limits, but some OTC partners may charge minimal fees. Below is a summary of typical fees and daily limits:

| Cash In Method | Fee | Daily Limit |

|---|---|---|

| Over-the-Counter (7-Eleven, Palawan Pawnshop) | ₱15 – ₱20 per transaction | ₱50,000 |

| Bank Transfer (InstaPay/PESO Net) | Usually Free | ₱100,000 |

| Credit/Debit Card | 1.5% – 2.0% service charge | ₱50,000 |

| Wallet-to-Wallet Transfer | Free | Based on wallet tiers |

How to Cash In Gcash: Step-by-Step Tutorial

Here’s a quick tutorial on how to charge cash in your Gcash wallet using the app:

- Open your Gcash app.

- Tap the “Cash In” button on the home screen.

- Select your preferred cash in method (e.g., Over-the-Counter, Bank Transfer, or Credit/Debit Card).

- Input the amount you wish to add to your wallet.

- Follow the instructions to complete the transaction (e.g., visit an outlet or input card details).

- Wait for notification confirming your wallet has been credited.

Benefits of Using Gcash for Cash In

- Multiple Cash-In Options: Flexibility to choose what suits you best.

- Instant Reload: Most transactions reflect immediately.

- Safe and Secure: Encrypted transactions within the app.

- No Need for Physical Bank Visits: Ideal for busy lifestyles.

- Wide Acceptance: Used by millions for everyday transactions.

Practical Tips When Charging Cash In Gcash

- Check Your Balance: Always verify your wallet balance after cash in.

- Use Trusted Outlets: Only cash in at authorized partner outlets to avoid scams.

- Keep Receipts: For OTC transactions, keep your receipt for verification.

- Monitor Fees: Some methods have charges, so check fees before cashing in.

- Verify Mobile Number: Double-check the mobile number linked to Gcash during transactions.

First-Hand Experience: My Gcash Cash In Journey

When I first started using Gcash, I found cashing in via 7-Eleven both convenient and fast. The staff was familiar with the process – I simply presented my mobile number, handed over the cash, and got an SMS confirmation within seconds. Linking my bank account later made loading funds even easier without stepping out of my house.

Today, I regularly use bank transfers and card reloads, saving time and avoiding service fees for cash-in. The entire Gcash ecosystem truly empowers users with choice and accessibility.

FAQs About Gcash Charge Cash In

Q1: How long does it take for cash in to reflect in my Gcash wallet?

Most methods credit your wallet almost instantly, except PESONet bank transfers which may take up to 1 business day.

Q2: Can I cash in without a bank account?

Yes! You can use over-the-counter cash in options at partner outlets without needing a bank account.

Q3: Is there a minimum cash in amount?

The minimum is typically ₱10 for most cash in options, though some partners may require ₱20 or more.

Q4: Are there wallet limits when cashing in?

Yes, Gcash wallets have different levels (Basic, Verified) with increasing limits. Verify your wallet to access higher limits.

Conclusion

Understanding the Gcash charge cash in process is key to unlocking the full potential of your digital wallet. With multiple safe, fast, and cost-effective methods available, you can easily top up your Gcash wallet anytime, anywhere. Whether you prefer over-the-counter loads, bank transfers, or card reloads, Gcash empowers you with flexible options and reliable service.

Keep these tips in mind and start enjoying the convenience of cashless financial transactions today! Your journey toward hassle-free money management begins the moment you load your first peso into your Gcash wallet.