Fast Cash Credit Lazada: Quick, Easy, and Convenient Financing Solution

In today’s fast-paced world, having access to fast and reliable cash credit options can make all the difference-especially when unexpected expenses arise or when you want to take advantage of exclusive online deals. Fast Cash Credit Lazada stands out as a convenient, trustworthy way to secure quick financing directly on one of Southeast Asia’s largest e-commerce platforms. This guide will explore how Fast Cash Credit Lazada works, its benefits, tips for usage, and why it is reshaping the way millions shop and borrow online.

What is Fast Cash Credit Lazada?

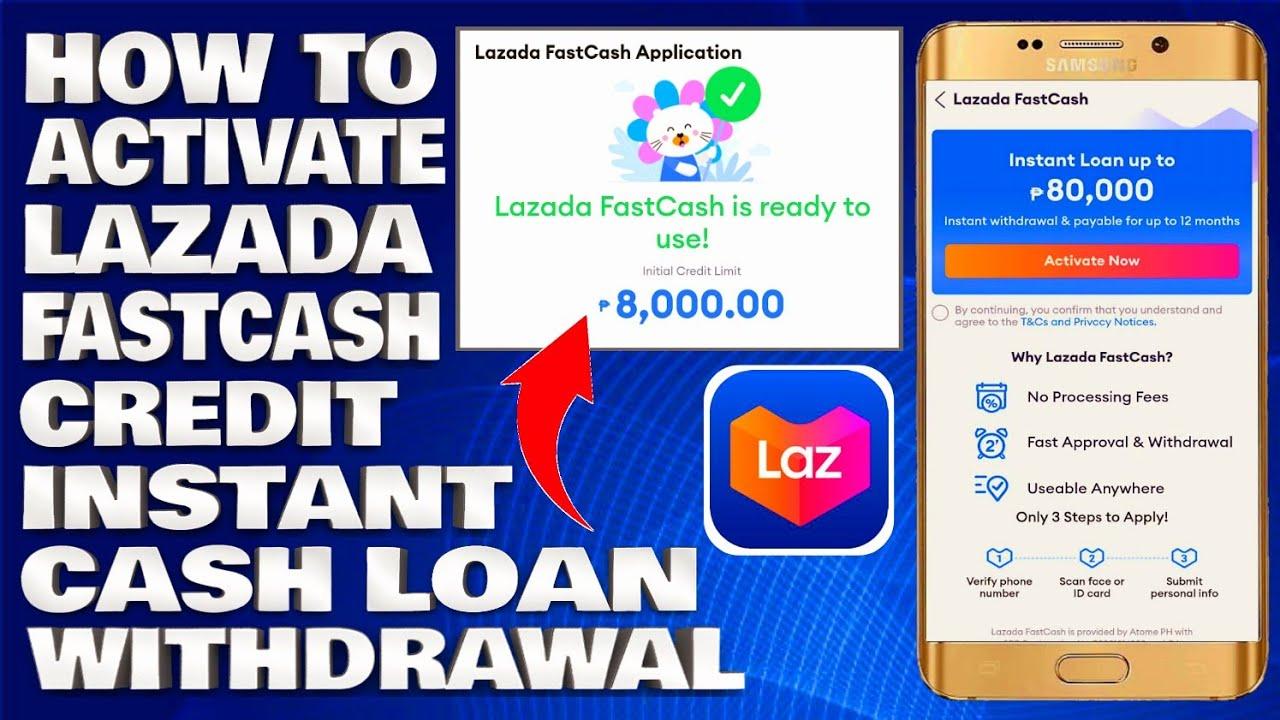

Fast Cash Credit Lazada is an instant loan or credit financing feature integrated into the Lazada platform. It allows users to borrow money quickly, usually with minimal paperwork and instant approval, to fund purchases or address urgent cash needs. Lazada partners with financial institutions and lending companies to offer this seamless credit facility to its users.

How Does Fast Cash Credit on Lazada Work?

- Eligibility Check: Users are pre-qualified based on their Lazada account history, payment behavior, and identity verification.

- Apply Online: Through the Lazada app or website, users can request a cash credit loan within minutes.

- Instant Approval: Most applications are approved instantly thanks to automated systems using AI and credit algorithms.

- Use the Credit: Borrowers can use the credit to pay for Lazada purchases or withdraw cash, depending on the offered options.

- Repayment: Flexible repayment terms including installments, usually integrated with your Lazada wallet or linked bank accounts.

Benefits of Using Fast Cash Credit on Lazada

Choosing Fast Cash Credit Lazada offers multiple advantages that make it a preferred choice for online shoppers and borrowers:

- Speed and Convenience: Apply and get credit in minutes without visiting physical branches.

- No Collateral Needed: It’s typically unsecured credit, meaning you don’t have to pledge assets.

- Flexible Repayment Options: Pay back in affordable installments aligning with your budget.

- Exclusive Discounts and Promos: Users can combine credit with Lazada’s exclusive sales and vouchers for maximum savings.

- Boosts Purchase Power: Allows buying desired items immediately without waiting to save money.

Table: Comparing Fast Cash Credit Lazada with Other Credit Options

| Feature | Fast Cash Credit Lazada | Traditional Bank Loan | Credit Card |

|---|---|---|---|

| Application Time | Minutes | Days to Weeks | Hours to Days |

| Approval Complexity | Simple, Automated | Detailed Documents Required | Moderate |

| Collateral Needed | No | Sometimes | No |

| Use Restrictions | Mostly Lazada Purchases | Flexible Use | Flexible Use |

| Repayment Terms | Installments via app | Structured schedule | Monthly bills |

Practical Tips for Using Fast Cash Credit Lazada Wisely

To make sure you maximize the benefits and avoid pitfalls, consider the following tips when using Fast Cash Credit Lazada:

- Read the Terms Carefully: Understand interest rates, fees, and repayment schedules before borrowing.

- Borrow Only What You Need: Don’t overextend yourself financially-plan purchases and repayment realistically.

- Check Eligibility Early: Keep your account details up-to-date to ensure faster processing.

- Use Credit for Value Purchases: Leverage credit for essential items or time-sensitive deals rather than impulse buys.

- Set Reminders for Payments: Avoid late fees and impact on credit scores by scheduling your repayments on time.

Real-Life Case Study: How Fast Cash Credit Lazada Helped Anna Secure Her Home Essentials

Anna, a working mom, needed a quick way to replace broken kitchen appliances to keep her household running smoothly. With a tight budget, she couldn’t make the lump sum purchase right away. Using Fast Cash Credit Lazada, Anna applied for and received an instant credit limit. She bought her appliances the same day during Lazada’s flash sale, saving 20% and paying for her purchases in easy monthly installments that fit her salary schedule. This made her shopping stress-free and affordable, and she highly recommends this solution for others in similar situations.

FAQs About Fast Cash Credit Lazada

Is Fast Cash Credit Lazada available in all countries?

Availability depends on your country’s regulations and Lazada’s partnerships with local financial institutions. Check your Lazada app for eligibility.

What is the interest rate for Fast Cash Credit Lazada?

Interest rates vary based on your credit profile and loan terms. Make sure to review all rates and fees before accepting credit offers.

Can I use the credit for non-Lazada purchases?

Generally, Fast Cash Credit is intended for Lazada-related transactions. Some programs also allow cash withdrawal, but it depends on your offer.

Conclusion: Is Fast Cash Credit Lazada Right for You?

Fast Cash Credit Lazada is an innovative and customer-friendly financing solution that brings together the speed of digital lending and the convenience of e-commerce. By providing quick access to funds with flexible repayment options, it empowers shoppers to seize great deals or manage urgent expenses without hassle. However, like any credit product, it requires smart borrowing habits and understanding of terms to truly benefit from it.

If you want fast, secure, and hassle-free access to funds while enjoying Lazada’s unbeatable deals, Fast Cash Credit Lazada could be your perfect financial companion.